You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Edmonton Real Estate Market

- Thread starter Daveography

- Start date

occidentalcapital

Senior Member

1 million sq ft of industrial to be developed- article says will proceed on spec

renx.ca

renx.ca

ONE, Vestcor buy Edmonton property, plan 1M sq. ft. of industrial

ONE Properties and Vestcor have partnered to acquire 41 Business Park, a property in Nisku, just outside Edmonton, where they plan to develop approximately one million square feet of industrial space.

archited

Senior Member

Re the Graph -- True mostly for Vancouver and Toronto.

northlands

Senior Member

Where is Ledcor moving their pipe fab and mod yard operations to then I wonder? Their heavy industrial and pipe fab divisions have sure seemed real busy the past couple years and have made that company an insane amount of money.1 million sq ft of industrial to be developed- article says will proceed on spec

ONE, Vestcor buy Edmonton property, plan 1M sq. ft. of industrial

ONE Properties and Vestcor have partnered to acquire 41 Business Park, a property in Nisku, just outside Edmonton, where they plan to develop approximately one million square feet of industrial space.renx.ca

IanO

Superstar

IanO

Superstar

Stevey_G

Active Member

What’s the TL DW?

The industrial RE agents were just spouting cliche blue-collar conservative talking points and the office RE folks were in denial about WFH as office vacancies rise.What’s the TL DW?

The multifamily guy with Remax was worth listening to though. Multifamily is looking up with a new program by the CMHC offering cheap, high leverage loans (90% LTV, 50 year amortizations, lower interest rates by 1-2%). The rental universe in Edmonton expanded about 10%, mostly from new construction in the deep south and Downtown.

Office to residential conversions aren't going to get much traction. Construction prices are too high and there is just so much available land ready to be built on. Calgary, by comparison, is much more restrictive with permitting density so the conversions are more feasible there.

IanO

Superstar

Here's hoping we see a boom in quality PBR (insert joke).

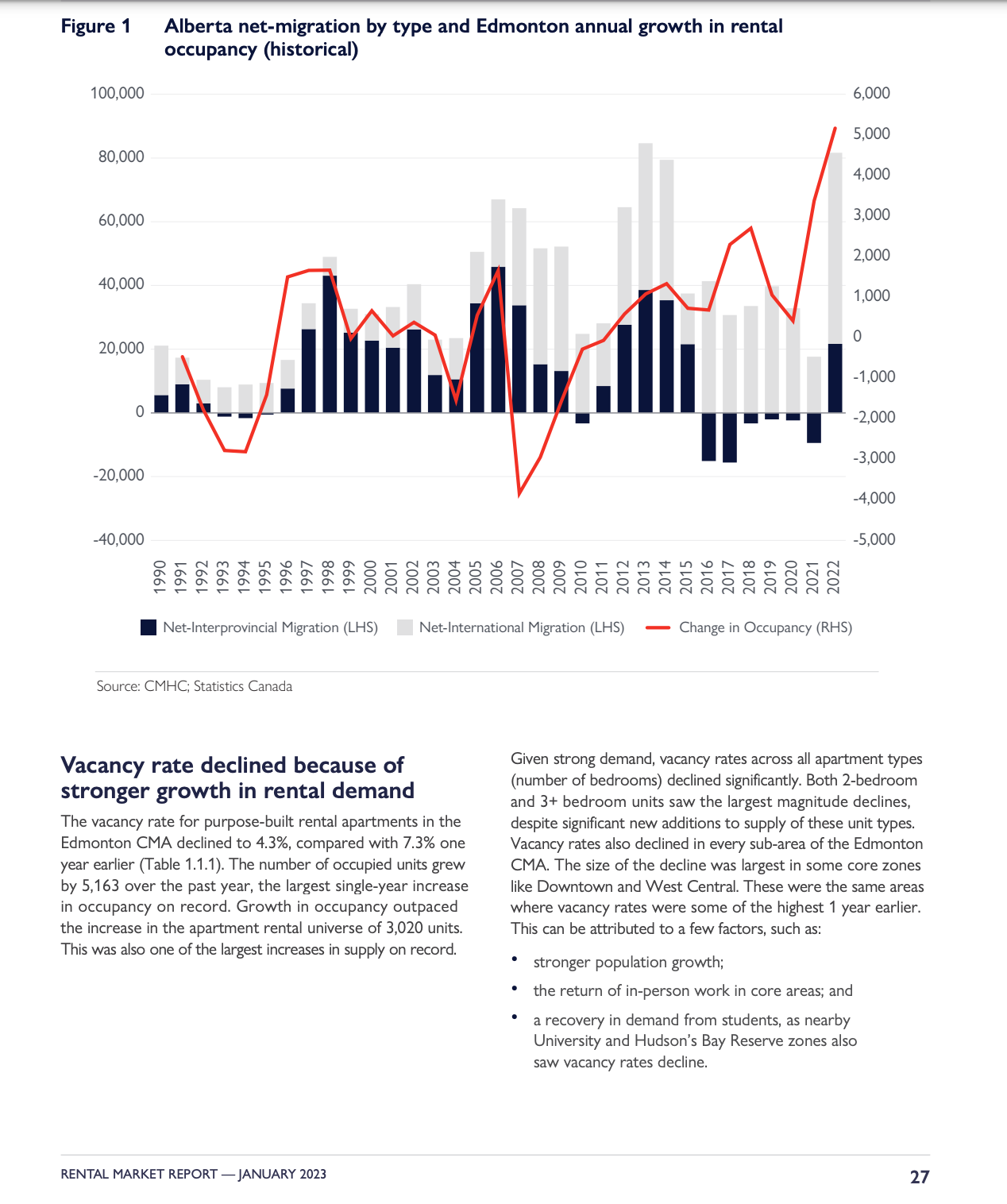

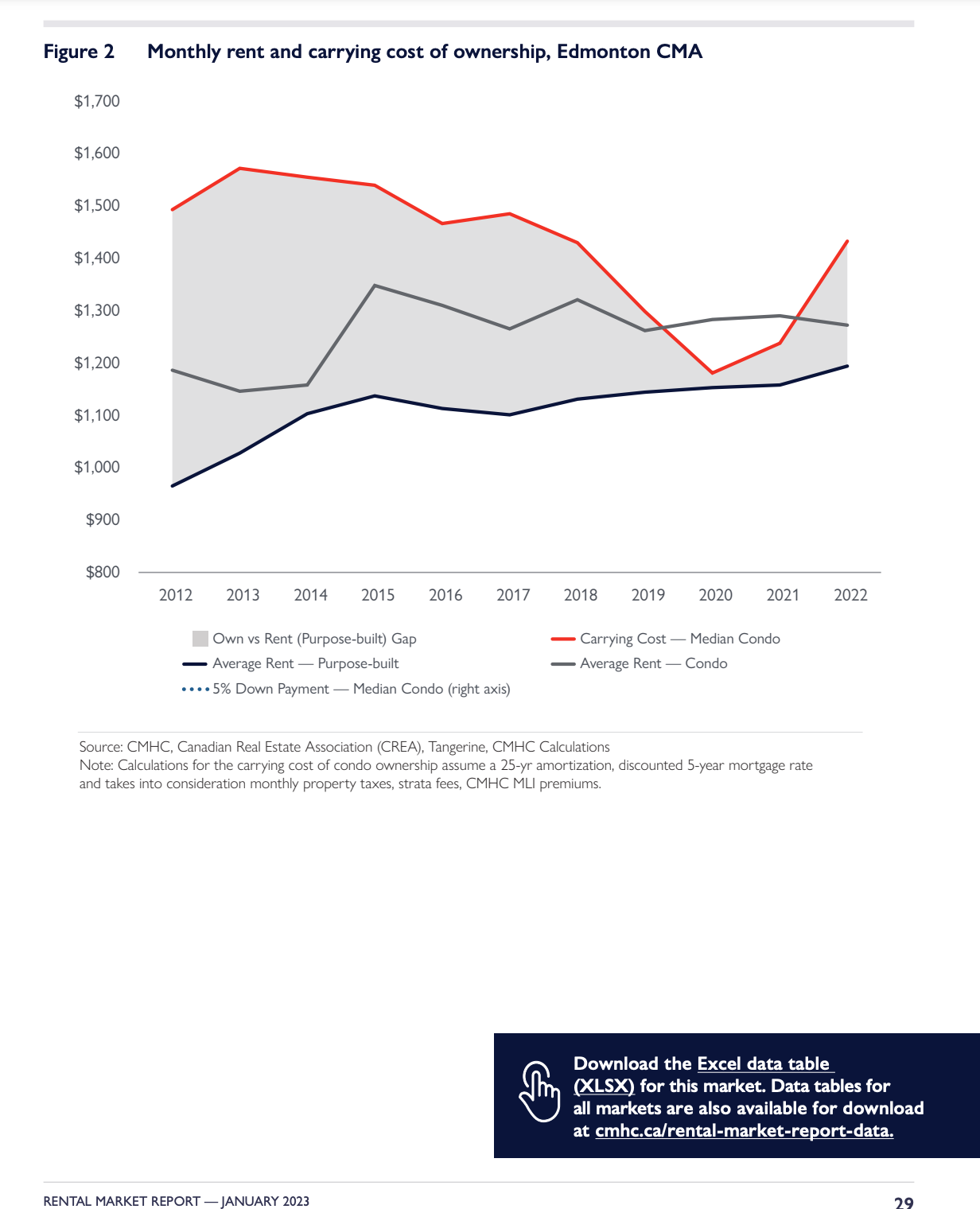

- Rental demand for purpose-built apartments in Edmonton outpaced rental supply in 2022 due to an economic rebound and record migration flows, according to the latest Rental Market Report from the Canada Mortgage and Housing Corporation. The vacancy rate fell from 7.3% in October 2021to 4.3% in October 2022. - Taproot

IanO

Superstar

^

Highlights from the latest Rental Market Report

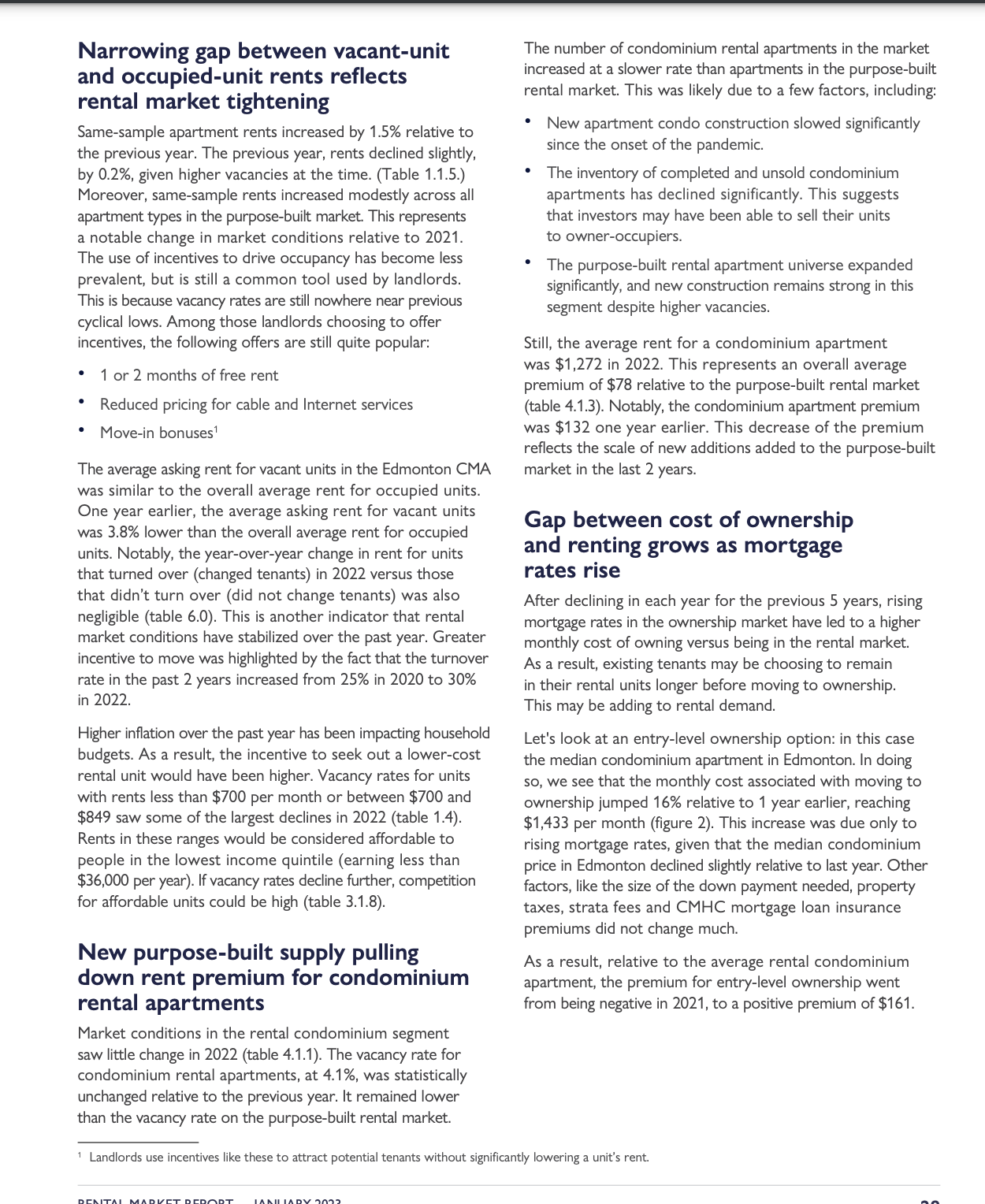

- The vacancy rate for purpose-built rental apartments decreased in 2022, while the demand for rental housing increased.

- Demand for rental housing outpaced the increase in supply in 2022, leading to a lower national vacancy rate compared to 2021.

- Higher net migration, increased homeownership costs and students returning to on-campus learning drove increased demand for rental housing.

- Rental affordability continues to pose a significant challenge across the country. There is a lack of affordable rental housing, especially for the lowest 20% of income earners.

- New analysis indicates that there was a significant gap between the average rent for 2-bedroom units that turned over to a new tenant and ones that did not.

Greenspace

Senior Member

Interesting podcast/chat about Edmonton vs. Vancouver real estate market for investors.

northlands

Senior Member

Neat seeing this. I had Ranon as a TA years ago lolInteresting podcast/chat about Edmonton vs. Vancouver real estate market for investors.

MacLac

Senior Member

What’s the jist of it?

IanO

Superstar

Canada Housing Market Risk Low, Despite Short-Term Contraction

While interest rate hikes destabilized the Canada housing market, homeowners are well-positioned to ride out the coming storm.

thommyjo

Senior Member

The prices in London are crazy. I kind of get Hamilton as part of the GTA still but London? I’d rather move to a dozen other cities personally before paying 700k for an old fixer upper there.View attachment 453653View attachment 453654View attachment 453655View attachment 453656

Canada Housing Market Risk Low, Despite Short-Term Contraction

While interest rate hikes destabilized the Canada housing market, homeowners are well-positioned to ride out the coming storm.blog.remax.ca