Kosy123

Senior Member

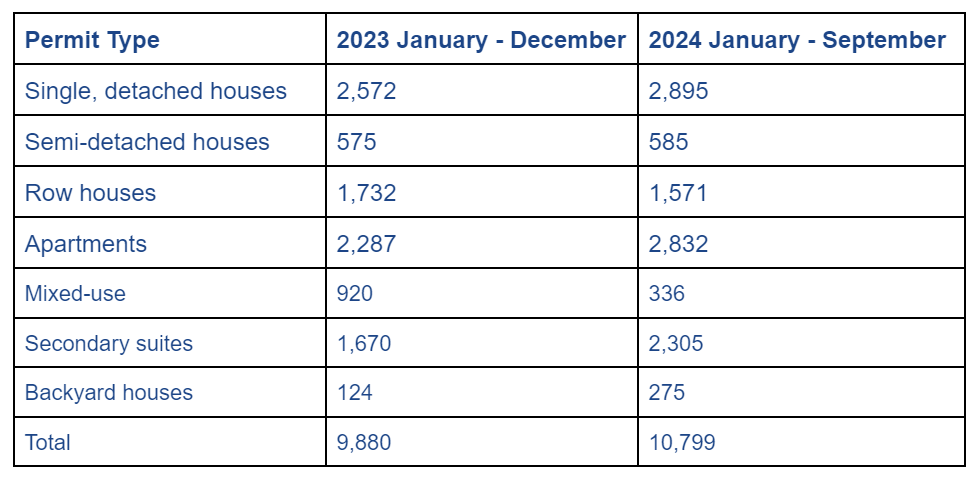

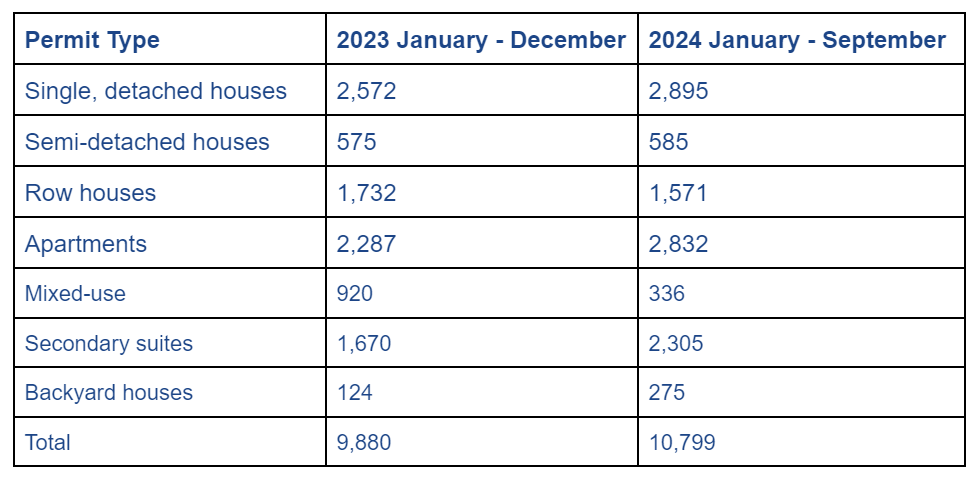

https://myemail.constantcontact.com...rmits.html?soid=1127191170163&aid=p1yRf-_5Q4w

We might see this turbocharged if the BoC actually drops rates by 50 bps next week. Hopefully that jolt finally gets some multifamily developments in the core started or sped up, especially downtown.

We might see this turbocharged if the BoC actually drops rates by 50 bps next week. Hopefully that jolt finally gets some multifamily developments in the core started or sped up, especially downtown.