Abba

Active Member

The rumours on this one... from an RFP hitting the streets in the coming weeks to the building getting shopped to CWB moving in?!?! At this point, let's just hope SOMETHING happens!

Personally I'm doubtful vacancies would grow any more than they already have. You're seeing the tail end of covid, less work from home, population growth in the region, and continued scale up efforts for startup firms, which over the mid term will create demand for office.What's going to happen to any of our office towers as vacancies grow and valuations go down? Downtown accounts for 10% of our City's tax base. If the tax base shrinks it will affect all taxpayers.

Cut and paste in almost all other downtowns right about now. The office asset class isn't that hawt right now...in fact, it's the exact opposite.Valuations are down and write-downs have occurred and is impacting the tax base.

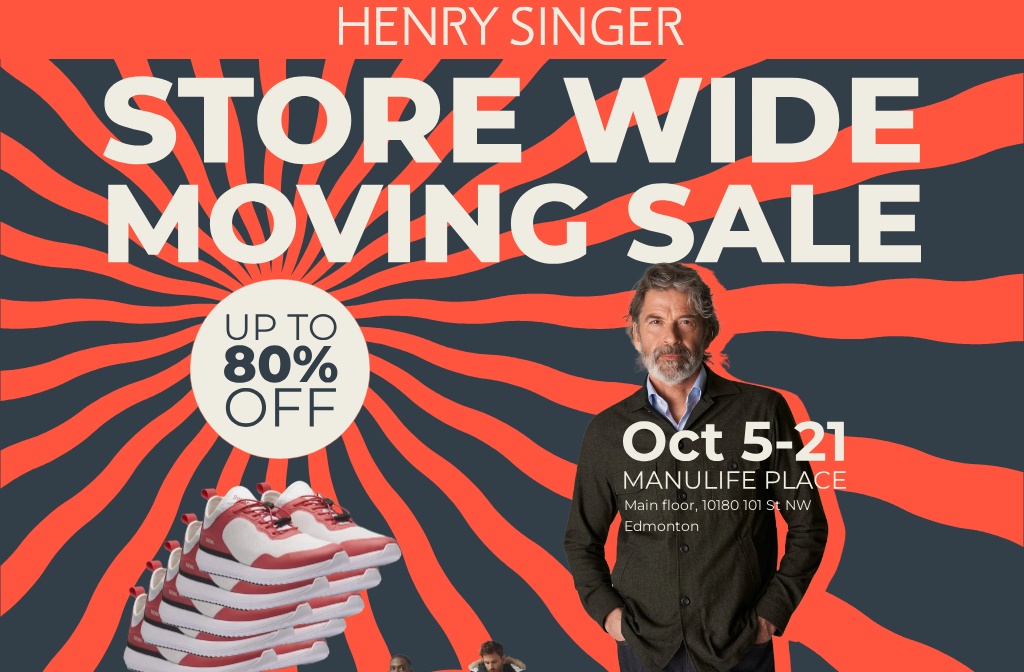

I hope this happens. Manulife is a good building. The podium level was hard hit by things over the last few years, but now is the right time to update and refresh the it, particularly as several of the long term tenants on the main level are not there now.Anyways, I've heard from one of the bigger GC's that there is an RFP coming back out for the podium....value around $30M IIRC. So that is good news.